Table of Contents

- Message from the Veterans Ombudsman

- The Mandate of the Veterans Ombudsman

- Report Summary

- Introduction

- Methodology

- Overview of Benefits

- Analysis

- Permanent Impairment Allowance Policy

- Permanent Impairment Allowance Statistics

- Permanent Impairment Allowance Supplement Policy

- Permanent Impairment Allowance Supplement Statistics

- Importance of the Permanent Impairment Allowance and Supplement for the Financial Security of the Most Severely Impaired Veterans

- Summary of Findings

- Improving Access to the Benefits

- Conclusion

- Recommendations

- Annex

- Footnotes

Message from the Veterans Ombudsman

I am pleased to offer to you this report that examines two New Veterans Charter financial support benefits provided to the most severely impaired Veterans – the Permanent Impairment Allowance and the Permanent Impairment Allowance Supplement (the Supplement).

Veterans who suffer from a permanent and severe impairment experience a greater economic impact than Veterans with a lesser degree of impairment. The Permanent Impairment Allowance and the Supplement are particularly important for the financial security of these Veterans. Regrettably, too many severely impaired Veterans are not receiving these benefits.

My office has received close to 100 calls from Veterans regarding these benefits. While many of the calls were requests for general information, half of these calls were complaints related to eligibility. This report identifies issues with how eligibility is determined and proposes solutions to properly align the objective of the Permanent Impairment Allowance and the Supplement with the criteria that are considered in determining eligibility for these benefits.

I urge the Government of Canada to quickly implement the report’s four recommendations so that the most severely impaired Veterans, those who suffer from severe life-altering disabilities that directly affect their employment and career advancement opportunities, receive the financial help they need.

The paper copy was signed by:

Guy Parent

Veterans Ombudsman

The Mandate of the Veterans Ombudsman

The Office of the Veterans Ombudsman ( OVO ) was created by Order in Council (P.C. 207-530, April 3, 2007). It works to ensure that Veterans, serving members of the Canadian Armed Forces and the Royal Canadian Mounted Police, as well as other clients of Veterans Affairs Canada ( VAC ), are treated respectfully, in accordance with the Veterans Bill of Rights, and receive the services and benefits that they require in a fair, timely and efficient manner.

The Office addresses complaints, emerging and systemic issues related to programs and services provided or administered by VAC , as well as systemic issues related to the Veterans Review and Appeal Board.

The Veterans Ombudsman is an independent and impartial officer who is committed to ensuring that Veterans and other clients of VAC are treated fairly. The Ombudsman measures fairness in terms of adequacy (Are the right programs and services in place to meet the needs?), sufficiency (Are the right programs and services sufficiently resourced?), and accessibility (Are eligibility criteria creating unfair barriers, and can the benefits and services provided by VAC be accessed quickly and easily?).

In accordance with the Veterans Bill of Rights, Veterans and all other clients of Veterans Affairs have the right to:

- be treated with respect, dignity, fairness and courtesy;

- take part in discussions that involve them and their family;

- have someone with them for support when they deal with Veterans Affairs;

- receive clear, easy-to-understand information about programs and services, in English or French, as set out in the Official Languages Act;

- have their privacy protected as set out in the Privacy Act; and

- receive benefits and services as set out in published service standards and to know their appeal rights.

They have the right to make a complaint to the OVO and have the matter looked into if they feel that any of their rights have not been upheld.

Report Summary

The Permanent Impairment Allowance is a financial support benefit provided under the Canadian Forces Members and Veterans Re-establishment and Compensation Act Footnote 1 (commonly referred to as the New Veterans Charter). It is awarded in three grade levels. Its objective is to compensate for loss of earning capacity; specifically, for the effects of a permanent and severe impairment on a Veteran’s employment and career progression opportunities.

The Permanent Impairment Allowance Supplement (the Supplement) provides additional financial support to those Veterans who are in receipt of the Permanent Impairment Allowance, are assessed to be totally and permanently incapacitated and are no longer able to participate in any suitable and gainful employment.Footnote 2

This report highlights that the predominance of functional, physical and mental criteria used to assess the extent of impairment does not meet the intent of the Permanent Impairment Allowance. In addition, the list of impairments contained in the Canadian Forces Members and Veterans Re-establishment and Compensation RegulationsFootnote 3 is restrictive and does not provide the flexibility to consider other permanent and severe impairments that can impact employment and career progression opportunities. These two deficiencies affect eligibility for the benefit.

The report also demonstrates that 48 percent of totally and permanently incapacitated Veterans are not receiving the Permanent Impairment Allowance or the Supplement. In addition, the overwhelming majority of allowance recipients, including many of the most seriously ill and injured Veterans, are awarded the benefit at the lowest grade level. The OVO could find no evidence that VAC disability adjudicators consider the effects of a permanent and severe impairment on a Veteran’s employment and career progression opportunities when assigning a grade level.

The report makes four recommendations to improve access to the Permanent Impairment Allowance and the Supplement for Veterans who suffer from any service-related permanent and severe impairment that affects their employment and career progression opportunities, and their survivor.

First, section 40 of the Canadian Forces Members and Veterans Re-establishment and Compensation Regulations should be expanded to include, “other permanent and severe injury or illness that affects employment and career progression opportunities” in the definition of a permanent and severe impairment. This will provide proper alignment between the definition of permanent and severe impairment and the objective of the Permanent Impairment Allowance.

Second, a change is required to the manner in which VAC disability adjudicators assess the extent of impairment and thus eligibility for the Permanent Impairment Allowance. This may also affect eligibility for the Supplement. Specific “loss of earning capacity” criteria are required in relevant regulations and VAC policies so that disability adjudicators also consider loss of employment and career progression opportunities when determining the extent of impairment.

Third, the effects that a permanent and severe impairment has on loss of employment and career progression opportunities must guide the assignment of Permanent Impairment Allowance Grade Levels; i.e., the greater the impact of the impairment on loss of employment and career progression opportunities, the higher the grade level that should be awarded. Only then will the amount of compensation provided to Veterans who suffer from a permanent and severe impairment be properly aligned with the Permanent Impairment Allowance policy objective.

The report also recommends that the full amount of the Permanent Impairment Allowance and the Supplement be provided to a survivor for one year following the death of the Veteran. This will allow the survivor to adjust to his or her new financial circumstances without the added stress of an immediate and significant reduction in income support. It also recognizes that the economic impact resulting from the Veteran’s severe impairment or total incapacity continues to affect the survivor’s financial situation after the Veteran’s death.

By implementing the recommendations in this report, VAC will improve accessibility to the Permanent Impairment Allowance and the Supplement for the most seriously ill or injured Veterans to compensate them for a lifetime of loss of employment and career progression opportunities. It will also provide a measure of financial stability and security to the Veteran’s survivor for one year after the death of the Veteran.

Introduction

VAC administers a number of programs that provide benefits and services to Veterans, serving Canadian Armed Forces ( CAF ) members, and their families.Footnote 4 Two of the financial benefits provided under the Canadian Forces Members and Veterans Re-establishment and Compensation Act (commonly referred to as the New Veterans Charter) - the Permanent Impairment Allowance and the Permanent Impairment Allowance Supplement (the Supplement) - were introduced to provide additional financial support to the most severely injured or ill CAF Veterans.Footnote 5

The Permanent Impairment Allowance is a taxable economic support benefit awarded in three grade levels. Its objective is to compensate for loss of earning capacity; specifically, for the effects a permanent and severe impairment has on loss of employment and career progression opportunities.Footnote 6 However, as this report will demonstrate, the criteria to assess eligibility for the benefit emphasize physical, mental and functional effects of the impairment, rather than the impact of the impairment on the earning capacity of the Veteran. In addition, the list of conditions that defines a permanent and severe impairment is restrictive and does not provide the flexibility to consider other permanent and severe injuries or illnesses that impact a Veteran’s employment and career progression opportunities.

The report demonstrates that there is a disconnect between the objective of the Permanent Impairment Allowance and the predominant use of functional, physical and mental criteria to assess the extent of impairment. This disconnect affects access to the benefit. In addition, because of how the extent of impairment criteria were designed, the overwhelming majority of eligible Veterans are awarded the lowest grade level, despite the fact that their impairment may have a profound impact on their employment and career progression opportunities.

The Permanent Impairment Allowance Supplement came into effect as a new taxable benefit on October 3, 2011 through the enactment of the Enhanced New Veterans Charter Act.Footnote 7 The objective of the Supplement is to provide additional financial support to Veterans who are in receipt of the Permanent Impairment Allowance, are assessed to be totally and permanently incapacitated and are no longer able to participate in any occupation considered to be suitable and gainful employment.Footnote 8 However, almost half of totally and permanently incapacitated Veterans are not receiving the Permanent Impairment Allowance and the Supplement.

Finally, contrary to certain other Veterans benefits, the Permanent Impairment Allowance and the Supplement are not provided to a survivor after the death of the Veteran. The discontinuation of these benefits presents an immediate and significant reduction in income support for the grieving spouse at a time of increased stress and financial uncertainty.

The June 2013 Veterans Ombudsman report, Improving the New Veterans Charter: The ReportFootnote 9 raised concerns about accessibility to the Permanent Impairment Allowance and the Supplement. This follow-on report details these concerns by analyzing the legislation, regulations and VAC policies and statistics related to these benefits. The report recommends four changes to improve access to the Permanent Impairment Allowance and the Supplement for those Veterans who suffer from any service-related permanent and severe impairment that impacts their employment and career progression opportunities, and for the survivor in the event of the Veteran’s death.

Methodology

The approach employed in this report included:

- the review of New Veterans Charter legislation and regulations, and VAC policies, guidelines and business practices with regards to the Permanent Impairment Allowance, the Supplement and the Exceptional Incapacity Allowance;Footnote 10

- the analysis of statistical information provided by VAC related to the Permanent Impairment Allowance and the Supplement;

- the review of a representative sample of decision letters sent to Veterans who applied for the Permanent Impairment Allowance and the Supplement;Footnote 11

- the analysis of complaints from Veterans to the OVO related to the Permanent Impairment Allowance and the Supplement; and

- modellingFootnote 12 the Permanent Impairment Allowance and the Supplement to determine the effects on the financial security of totally and permanently incapacitated Veterans after age 65.

Overview of Benefits

Permanent Impairment Allowance

The Canadian Forces Members and Veterans Re-establishment and Compensation ActFootnote 13 establishes a taxable monthly Permanent Impairment Allowance that may be paid to a Veteran who has one or more physical or mental health problems which create a permanent and severe impairment. The Regulatory Amendment to this legislation, dated July 9, 2011, confirms in its Regulatory Impact Analysis Statement that the objective of the New Veterans Charter Permanent Impairment Allowance is compensation in recognition of the loss of opportunity that a permanent and severe impairment has on employment and career progression.Footnote 14

The Canadian Forces Members and Veterans Re-establishment and Compensation Act lists two conditions that must be met before the Minister may pay this allowance to a Veteran who suffers from a physical or mental health problem that is creating a permanent and severe impairment, namely:

- the Veteran has an application for Rehabilitation Services approved for the health condition causing the impairment; and

- the Veteran has received a disability benefit for the health condition causing the impairment.Footnote 15

The definition of what constitutes a “permanent and severe impairment” is contained in the Canadian Forces Members and Veterans Re-establishment and Compensation Regulations, and amplified in VAC policies. The term is defined as any one of the following:

- an amputation at or above the elbow or the knee;

- an amputation of more than one upper or lower limb at any level;

- a total and permanent loss of the use of a limb;

- a total and permanent loss of vision, hearing or speech;

- a severe and permanent psychiatric condition that presents symptoms of considerable impairment of the Veteran’s functioning;

- a permanent requirement for the physical assistance of another person for most (policy states “at least four”) activities of daily living;Footnote 16 or

- a permanent requirement for supervision (policy states “on at least a twice per week basis for at least one hour”).Footnote 17

The Regulations also list the criteria that VAC must consider when assessing the extent of impairment, namely:

- the need for institutional care;

- the need for supervision and assistance;

- the degree of loss of use of a limb;

- the frequency of the symptoms;

- the degree of the psychiatric impairment; and

- the degree of loss-of-earnings capacity for persons with similar impairments.Footnote 18

The extent of impairment is further amplified in VAC policy in three domains:

- functional - level of requirement for assistance and supervision;

- physical - loss or loss of use of limb(s), vision, hearing or speech; and

- mental - degree of psychiatric impairment/frequency of symptoms.Footnote 19

The Disability Adjudicators at the VAC Head Office in Charlottetown determine if a Veteran meets the eligibility criteria for the Permanent Impairment Allowance. The adjudication process includes a review of the Veteran’s application form and other supporting documentation spanning at least two years that details the medical condition and level of impairment.

The allowance is payable in three grade levels based on an assessment of the extent of the functional, physical or mental impairment.Footnote 20 While VAC policy states that the degree of loss of earning capacity is also to be considered, the OVO was unable to find specific criteria in policy to guide this consideration.

Once the grade level is assigned, an amount corresponding to that grade level is paid to the Veteran on a monthly basis, at the following taxable rates:Footnote 21

- grade I: $1,724.65;

- grade II: $1,149.78; and

- grade III: $574.89.

The allowance is paid for life as long as the eligibility criteria continue to be met. The allowance ceases to be paid upon the death of the Veteran.

The allowance begins to be payable on the later of:

- the day on which the application for the allowance was made. VAC considers that an application has been made when all application requirements are met to the satisfaction of the Department; or

- the day that is one year prior to the decision date.Footnote 22

VAC advises that the primary reasons applicants are denied the Permanent Impairment Allowance are because:

- they are in receipt of an Exceptional Incapacity Allowance;Footnote 23

- they have not been approved for rehabilitation services through VAC ’s Rehabilitation Program for the condition causing the permanent impairment; or

- they do not meet the criteria for the allowance (i.e. there is insufficient evidence that the applicant suffers from a permanent and severe impairment).

Finally, Veterans can appeal a decision regarding eligibility for the Permanent Impairment Allowance through the Veterans Affairs Canada National First Level Appeals Unit (Atlantic Regional Office) and the Second Level Appeals Unit (Policy Division, Charlottetown Head Office).Footnote 24

Permanent Impairment Allowance Supplement

The Supplement is a taxable monthly benefit, in the amount of $1,056.96,Footnote 25 that came into effect on October 3, 2011 through the enactment of the Enhanced New Veterans Charter Act. It is payable for the life of the Veteran as long as eligibility is maintained. The July 9, 2011 Regulatory Amendment to this legislation confirms in its Regulatory Impact Analysis Statement that the objective of the Supplement is to provide additional financial support to those Veterans who are assessed to be totally and permanently incapacitated, and are no longer able to participate in any occupation that is considered to be suitable and gainful employment.Footnote 26

Veterans Affairs Canada policy specifies that in order to be eligible for the Supplement, a Veteran must be in receipt of the Permanent Impairment Allowance at any grade level and must be totally and permanently incapacitated.Footnote 27 Canadian Forces Members and Veterans Re-establishment and Compensation Regulations define a totally and permanently incapacitated Veteran as someone who is, “… incapacitated by a permanent physical or mental health problem that prevents the Veteran from performing any occupation that is considered to be suitable and gainful employment”.Footnote 28

Suitable and gainful employment is defined in Canadian Forces Members and Veterans Re-establishment and Compensation Regulations as, “… employment for which the Veteran is reasonably qualified by reason of education, training and experience and that provides a monthly rate of pay equal to at least 662/3 percent of the imputed income of the Veteran [i.e. 66 2/3 percent of either the Veteran’s indexed monthly pre-release military salary or basic corporal salary at time of application, whichever is greater]…”.Footnote 29

There is an expectation that the health conditions causing the total and permanent incapacity will not improve to the extent that will allow the Veteran to regain the ability to perform suitable and gainful employment. In cases where the Veteran has more than one health problem, the total and permanent incapacity designation must be related to the health problem(s) for which the Veteran was made eligible for rehabilitation services.

In short, in order to receive the Supplement, the Veteran must be both eligible for the Permanent Impairment Allowance, and totally and permanently incapacitated.

The Case Manager is the authority to designate a Veteran as totally and permanently incapacitated. The Case Manager initiates the process by counseling the Veteran regarding the purpose and implications of a totally and permanently incapacitated designation and by obtaining the Veteran’s consent to proceed with the assessment process. To render the decision, the Case Manager assesses information from a variety of sources, including:

- the Case Manager’s Client Centered Assessment;

- the Functional Capacity Assessment;

- the employability assessment and/or vocational assessment from the vocational rehabilitation and assistance provider; and

- Service Income Security Insurance Plan Long-Term Disability Plan reports.

The Case Manager communicates in writing to the Veteran a favourable or unfavourable decision regarding total and permanent incapacity. VAC policy states that the decision letter is to include the rationale for the decision, the effective date and the right to appeal.Footnote 30 A review of a favourable decision is conducted two years after the initial decision to confirm that the Veteran continues to be totally and permanently incapacitated.

The Supplement becomes payable on the later of:

- the day on which the application for the Supplement was made; or

- the day that is one year prior to when the application for the Supplement is approved.

The effective date of the Supplement cannot be sooner than the date the Veteran was determined to be totally and permanently incapacitated or determined to be eligible for the Permanent Impairment Allowance. In addition, the effective date cannot pre-date the October 3, 2011 implementation date of the Supplement.

The adjudication and appeal processes for the Supplement are the same as those for the Permanent Impairment Allowance. Finally, the Supplement payment is discontinued if the Veteran’s total and permanent incapacity status changes or on the day of the Veteran’s death.

Exceptional Incapacity Allowance

The Exceptional Incapacity Allowance is a tax-free monthly special award provided under the Pension Act.Footnote 31 While this allowance is not a specific focus of this report, it is described briefly because its purpose is to compensate CAF members and Veterans, including traditional Veterans,Footnote 32 for exceptional impairment.

The Exceptional Incapacity Allowance is provided to eligible pensioners who suffer an exceptional incapacity that is a consequence of or caused in whole or in part by, the disability for which the pensioner is receiving a disability benefit. This Pension Act allowance is non-economic compensation based on the extent of helplessness, pain, loss of enjoyment of life and shortened life expectancy of the pensioner. In contrast, the Permanent Impairment Allowance and the Supplement are taxable monthly economic support benefits that compensate for loss of employment and career progression opportunities or the inability to engage in suitable, gainful employment.

The Exceptional Incapacity Allowance is paid in five (5) grade levels, with rates ranging from $461.75 to $1,385.20 per month.Footnote 33 If the pensioner has been awarded an Exceptional Incapacity Allowance at the time of death, then the allowance continues to be paid to the survivor for one year following the death of the pensioner. Again in contrast, the Permanent Impairment Allowance and the Supplement cease to be paid upon the death of the Veteran.

To qualify for the Exceptional Incapacity Allowance, the applicant must be in receipt of:

- a Disability Pension for condition(s) that total 98 percent or more; or

- a Disability Pension and a Disability Award for conditions that total 98 percent or more; or

- a Disability Pension and Prisoner of War compensation totaling 98 percent or more; and

- have an exceptional incapacity that is a result of, in whole or in part, the condition(s) for which [the Veteran is] receiving a disability benefit.Footnote 34

The following criteria are considered when assessing the pensioner’s eligibility for the Exceptional Incapacity Allowance and when assigning a grade level:

- the degree of helplessness due to the pensioner’s physical limitations (e.g. ability to perform activities of daily living);

- the severity and type of pain experienced by the pensioner, methods used for pain relief/control and level of discomfort;

- the inability to participate in activities previously enjoyed in life;

- the shortening of life expectancy based on the pensioner’s age and medical condition; and

- how the disabilities have contributed to psychological problems.

The Pension Act states that a Veteran who is eligible for the Permanent Impairment Allowance is not eligible to be awarded the Exceptional Incapacity Allowance.Footnote 35 Also, VAC policy specifies that a Veteran who applies for the Exceptional Incapacity Allowance must first be considered for the Permanent Impairment Allowance before eligibility for the Exceptional Incapacity Allowance can be considered.

Analysis

Permanent Impairment Allowance Policy

Definition of “Permanent and Severe Impairment”

As discussed in the previous section, impairments that are considered permanent and severe are listed in the Canadian Forces Members and Veterans Re-establishment and Compensation Regulations section 40, and amplified in VAC policy. The list that defines a permanent and severe impairment is quite specific; for example, an amputation at or above the knee, a total and permanent loss of vision, hearing or speech, the permanent requirement for assistance with activities of daily living, etc. However, the list does not provide flexibility to consider other permanent and severe impairments that, though they may not necessitate a requirement for supervision or assistance, could have a significant impact on a Veteran’s employment and career progression opportunities.

A simple example underscores this observation. Veteran A suffers from a severe service-related bowel control problem for which he has received a Disability Award and has been approved for rehabilitation services.Footnote 36 The health condition is not expected to improve. He requires little assistance to deal with activities of daily living and does not require supervision. His impairment is not listed in the Canadian Forces Members and Veterans Re-establishment and Compensation Regulations section 40; however, his condition has a significant impact on his employment and career progression opportunities. Based on the Canadian Forces Members and Veterans Re-establishment and Compensation Regulations and VAC policy, this Veteran is not eligible for the Permanent Impairment Allowance.

Veteran B suffers a single amputation of his right leg at the knee and is awarded a Permanent Impairment Allowance at grade level 3.Footnote 37 Despite his impairment, the Veteran completes an Individual Vocational Rehabilitation Plan and finds employment as a financial counselor, which pays a higher salary than his pre-release military salary. Notwithstanding the fact that the impairment has little impact on this Veteran’s new civilian career, he will continue to receive the allowance because his impairment meets the physical impairment criteria for a grade level 3 - a single lower amputation at or above the knee.

While the extent of Veteran B’s physical impairment is not in question - an amputated limb is unquestionably a permanent and severe impairment - Veteran A’s impairment is also permanent and quite severe and, contrary to Veteran B’s impairment, it has a significant impact on his earning capacity. Yet, Veteran A is denied the allowance.

VAC confirmedFootnote 38 that Veterans have been granted the Permanent Impairment Allowance for medical conditions such as Traumatic Brain Injury, Multiple Sclerosis, Amyotrophic Lateral Sclerosis (also known as Lou Gehrig’s Disease) and malignant cancers, conditions that are not specifically listed in the Canadian Forces Members and Veterans Re-establishment and Compensation Regulations paragraph 40 (a) to (e).Footnote 39 However, the allowance was granted to these Veterans under paragraph 40 (f), a permanent requirement for physical assistance of another person for most activities of daily living, and/or paragraph 40 (g), a permanent requirement for supervision. The OVO could find no indication that the allowance was granted to these Veterans because of the effect of the impairment on loss of employment and career progression opportunities.

Policy Objective and Criteria for Assessing the Extent of Impairment

The Permanent Impairment Allowance recognizes that a Veteran who suffers from a permanent and severe impairment experiences a greater economic impact than does a Veteran with a lesser degree of impairment. This recognition is reflected in the published objective of the allowance - to compensate a Veteran for the effects a permanent and severe impairment has on loss of employment and career progression opportunities (i.e. loss of earning capacity).

The objective of the Permanent Impairment Allowance is clear, but there is a disconnect between this objective and the criteria that are considered by VAC disability adjudicators when they assess the extent of impairment and thus eligibilityFootnote 40 for the allowance. The criteria listed in VAC policyFootnote 41 to determine the extent of impairment emphasize physical, mental and functional conditions; for example, the requirement for assistance and supervision, degree of physical loss, degree of mental impairment, frequency of symptoms, etc. However, loss of earning capacity is not included in the list of criteria to consider when assessing extent of impairment.

The OVO reviewed a representative sample of VAC decision letters sent to Veterans who applied for the Permanent Impairment Allowance. Of the 156 letters that denied eligibility for the allowance, the reasons cited for denial were predominantly related to physical, mental or functional criteria, such as: no assistance required for most activities of daily living; no need for supervision; and, insufficient evidence of permanent and severe impairment.

Only two of the 156 denial letters mentioned that one of the reasons for denying the application was that the applicant was working on a full-time basis. Another denial letter acknowledged that the applicant’s health problems impaired his ability to return to work, but denied the application because he did not require supervision and assistance with most activities of daily living. These letters demonstrate that the impact of a permanent and severe impairment on loss of employment and career progression opportunities is typically not a determinant in establishing eligibility for the allowance.

The OVO also reviewed 350 letters that approved an application for the Permanent Impairment Allowance. The reasons cited for approving the application were again predominantly based on the applicant satisfying functional, physical or mental criteria. Only ten percent of these approval letters mentioned the Veteran’s inability to return to regular work.

These decision letters substantiate the disconnect between the objective of the Permanent Impairment Allowance and the preponderance of functional, physical and mental criteria used by disability adjudicators to assess the extent of impairment and eligibility for the benefit. When queried, VAC officials could not explain why specific loss of earning capacity criteria is not included in departmental policies and business process documentation. However, the officials claimed that notwithstanding the lack of published criteria, loss of earning capacity is given due consideration by disability adjudicators when determining the extent of impairment.

In summary, the adjudication of an application for the Permanent Impairment Allowance is weighted towards considering the functional, physical and/or mental effects of impairment. This is inconsistent with the objective of the benefit, which is to compensate a Veteran for loss of employment and career progression opportunities that result from a permanent and severe impairment.

Grade Levels

VAC advised that the Permanent Impairment Allowance Grade Levels were developed based on research conducted on indicators for determining the extent of severe impairment, such as the need for institutionalized care, the need for supervision and assistance with activities of daily living, etc. All of these indicators can impact employment potential and career advancement opportunities.

The Permanent Impairment Allowance Grade Level dollar amounts were established to approximate the Exceptional Incapacity Allowance Grade Level dollar amounts. As the Permanent Impairment Allowance is a taxable benefit and the Exceptional Incapacity Allowance is a tax-free benefit, the dollar amounts were set to take into account the effect of taxation.

The issue with grade levels is that Permanent Impairment Allowances are typically awarded at the lowest level. The OVO could find no evidence that disability adjudicators consider the effect of a permanent and severe impairment on a Veteran’s loss of employment and career progression opportunities when assigning a grade level.

Termination of the Permanent Impairment Allowance upon Death of the Veteran

As mentioned in the ‘Overview of Benefits’ section, the Permanent Impairment Allowance ceases when the Veteran dies. In contrast, another financial support benefit provided under the New Veterans Charter - the Earnings Loss Benefit - continues to be paid to survivors/orphans until the Veteran would have reached the age of 65.Footnote 42 This ensures that survivors continue to receive the financial support they require to satisfy basic needs of living.

The Earnings Loss Benefit is not the only VAC financial benefit that continues to be paid to a Veteran’s survivor. Certain benefits provided under the Pension Act, including the afore-mentioned Exceptional Incapacity Allowance, are also paid to the survivor at the full rate for a period of one year following the death of the Veteran. In addition, the Pension Act provides a survivor benefit for life based on the level of Disability Pension the Veteran was receiving at time of death.Footnote 43 It is unclear why the Permanent Impairment Allowance and the Supplement are not extended to survivors.

Survivors have communicated to the OVO how important the one year continuation of financial support benefits is to them. It allows them to grieve their loss and adjust to their new financial circumstances without the added stress of an immediate and significant reduction in income support.

Finally, VAC advisedFootnote 44 that there are 75 Veterans in receipt of the Permanent Impairment Allowance who are not receiving the New Veterans Charter Earnings Loss Benefit or Pension Act benefits.Footnote 45 After the death of these Veterans, the Permanent Impairment Allowance ceases immediately and the survivor is provided no financial support whatsoever from VAC .Footnote 46

Permanent Impairment Allowance StatisticsFootnote 47

Eligibility for the Permanent Impairment Allowance

Prior to the October 3, 2011 enactment of the Enhanced New Veterans Charter Act,Footnote 48 54 Veterans were in receipt of the Permanent Impairment Allowance. As of September 30, 2013, the number was 1,190. It is clear that the Enhanced New Veterans Charter Act has had a positive effect on improving access to the Permanent Impairment Allowance.

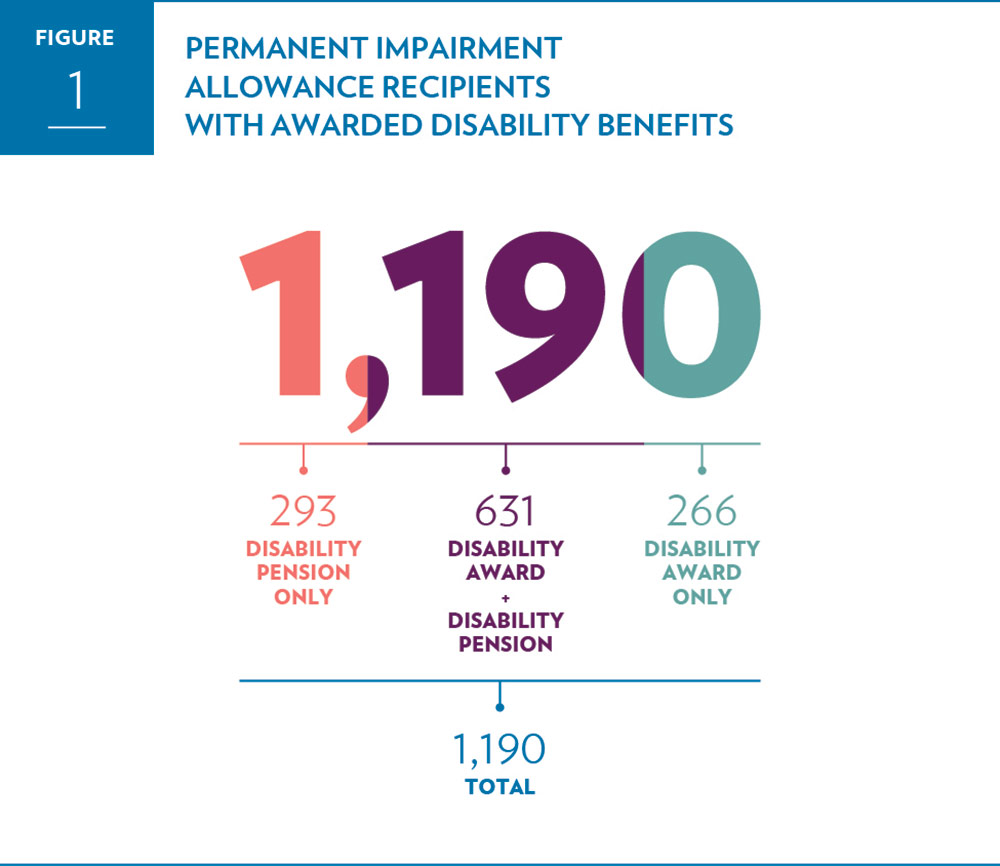

One of the reasons for this increase is that the Enhanced New Veterans Charter Act added the Disability Pension to the eligibility criteria for the Permanent Impairment Allowance.Footnote 49 As illustrated at Figure 1, of the 1,190 Veterans in receipt of the Permanent Impairment Allowance, 924 Veterans (78 percent) are in receipt of a Disability Pension or both Disability Award and Disability Pension.

Figure 1: Permanent Impairment Allowance recipients with awarded disability benefits.

Permanent Impairment Allowance recipients with awarded disability benefits

| Disability Pension Only | Disability Award + Disability Pension | Disability Award Only | Total |

|---|---|---|---|

| 293 | 631 | 266 | 1,190 |

Notwithstanding the improved access to the Permanent Impairment Allowance, numerous Veterans who are assessed to be totally and permanently incapacitated are not receiving the allowance.

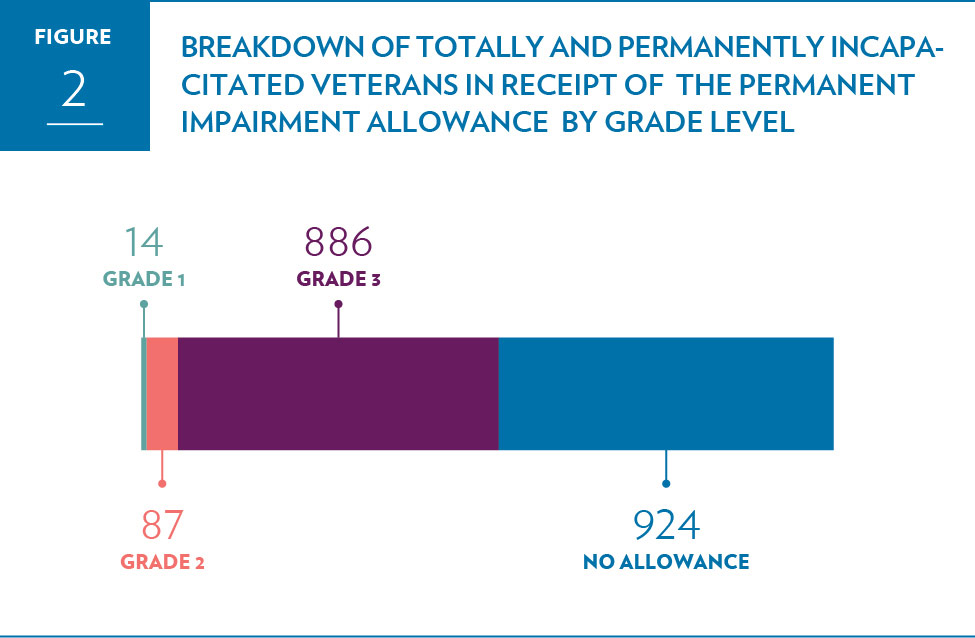

Figure 2, shows the breakdown of totally and permanently incapacitated Veterans in receipt of the Permanent Impairment Allowance by grade level. Of the 1,911 Veterans who are assessed to be totally and permanently incapacitated, 924Footnote 50 or 48 percent are not receiving the Permanent Impairment Allowance. This will be discussed in greater detail in the next section.

Figure 2: Breakdown of totally and permanently incapacitated Veterans in receipt of the Permanent Impairment Allowance by grade level.

Breakdown of totally and permanently incapacitated Veterans in receipt of the Permanent Impairment Allowance by grade level.

| Grade 1 | Grade 2 | Grade 3 | No Allowance |

|---|---|---|---|

| 14 | 87 | 886 | 924 |

Allowance Grade Levels

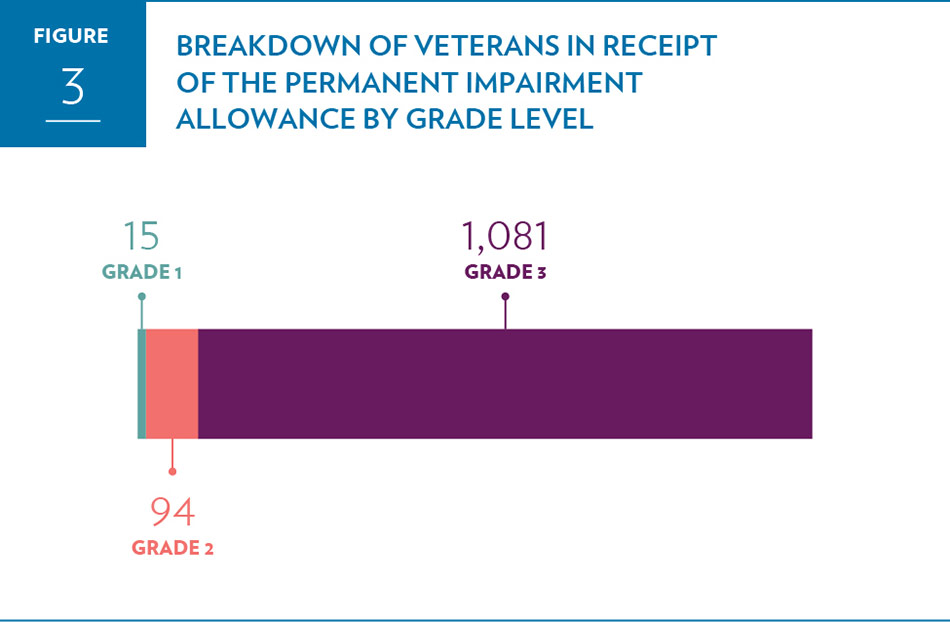

Figure 2 also shows that of the 987 totally and permanently incapacitated Veterans who are in receipt of the Permanent Impairment Allowance, 886 (90 percent) are awarded the lowest grade level. Figure 3 further illustrates the breakdown of Permanent Impairment Allowance recipients by grade level for all Veterans in receipt of the allowance. The predominance of the lowest grade level is again apparent (91 percent).

Figure 3: Breakdown of Permanent Impairment Allowance recipients by grade level for all Veterans in receipt of the allowance

Breakdown of Permanent Impairment Allowance recipients by grade level for all Veterans in receipt of the allowance

| Grade 1 | Grade 2 | Grade 3 |

|---|---|---|

| 15 | 94 | 1,081 |

These statistics corroborate the earlier observation that there is a disconnect between the Permanent Impairment Allowance policy objective and the assignment of grade levels. Considering that the objective of the benefit is to compensate Veterans for the effect of a permanent and severe impairment on loss of employment and career progression opportunities, the Veterans Ombudsman is concerned that the majority of Veterans who are in receipt of the allowance, particularly totally and permanently incapacitated Veterans who likely suffer from the greatest loss of employment and career progression opportunities, are awarded the lowest grade level.

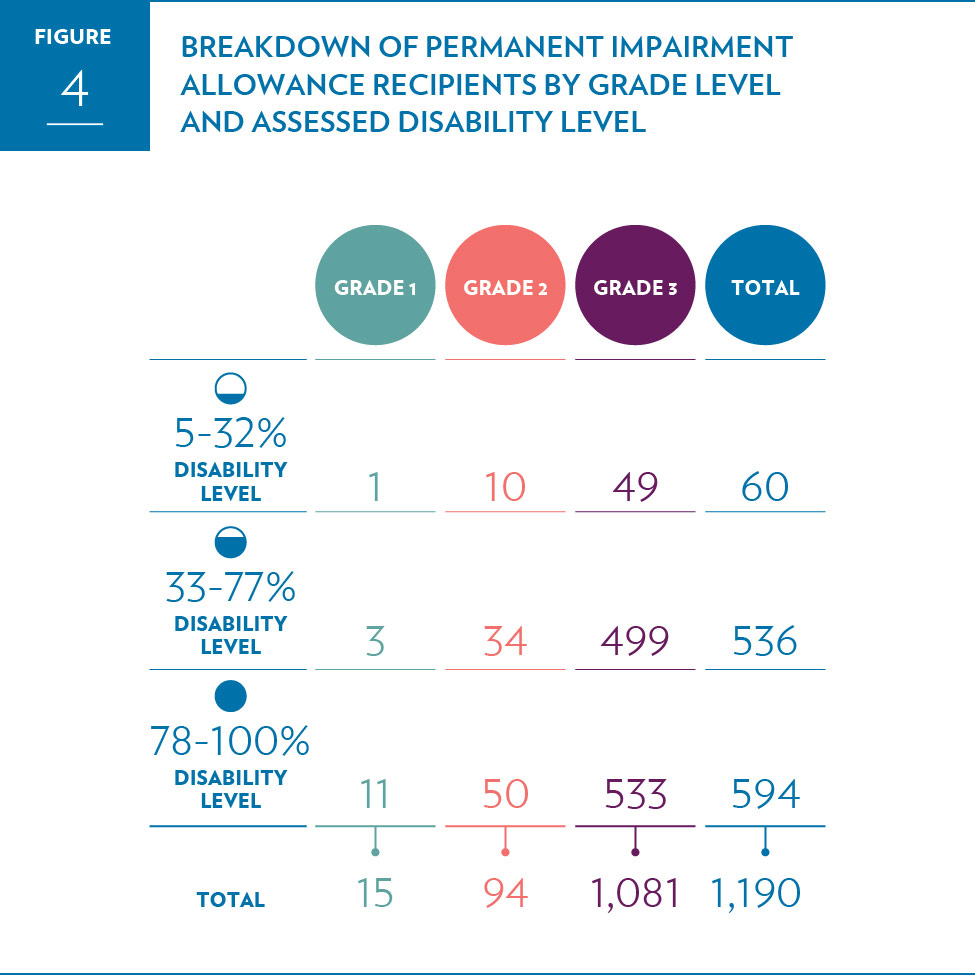

An additional analysis was conducted at Figure 4 to determine whether a relationship exists between Permanent Impairment Allowance Grade Levels and assessed disability levels.

Figure 4: Breakdown of Permanent Impairment Allowance recipients by grade level and assessed disability level.

Breakdown of Permanent Impairment Allowance recipients by grade level and assessed disability level.

| Disability Level | Grade 1 | Grade 2 | Grade 3 | Total |

|---|---|---|---|---|

| 5-32% | 1 | 10 | 49 | 60 |

| 33-77% | 3 | 34 | 499 | 536 |

| 78-100% | 11 | 50 | 533 | 594 |

| Total | 15 | 94 | 1,081 | 1,190 |

The salient points from this analysis are presented below.

- Of the total 1,190 recipients of the Permanent Impairment Allowance:

- 533 Veterans (45 percent) have the highest disability levels but receive the allowance at the lowest grade level; and

- 15 Veterans (1 percent) receive the allowance at the highest grade level.

- Of the 594 Veterans (50 percent of the total allowance recipients) with a disability level greater than 77 percent:

- 533 Veterans (90 percent) receive the allowance at the lowest grade level; and

- only 11 Veterans (2 percent) receive the allowance at grade level 1.

While these statistics are revealing, it is difficult to establish a clear relationship between the Permanent Impairment Allowance Grade Level and awarded disability level because disability level is not a definitive indicator of extent of impairment. However, the statistics are further evidence that most Permanent Impairment Allowance recipients receive the benefit at the lowest grade level even though their awarded level of disability may be quite high. The data also indicates that it is possible to receive the Permanent Impairment Allowance for conditions that are assessed to be low levels of disability.

Other Statistics

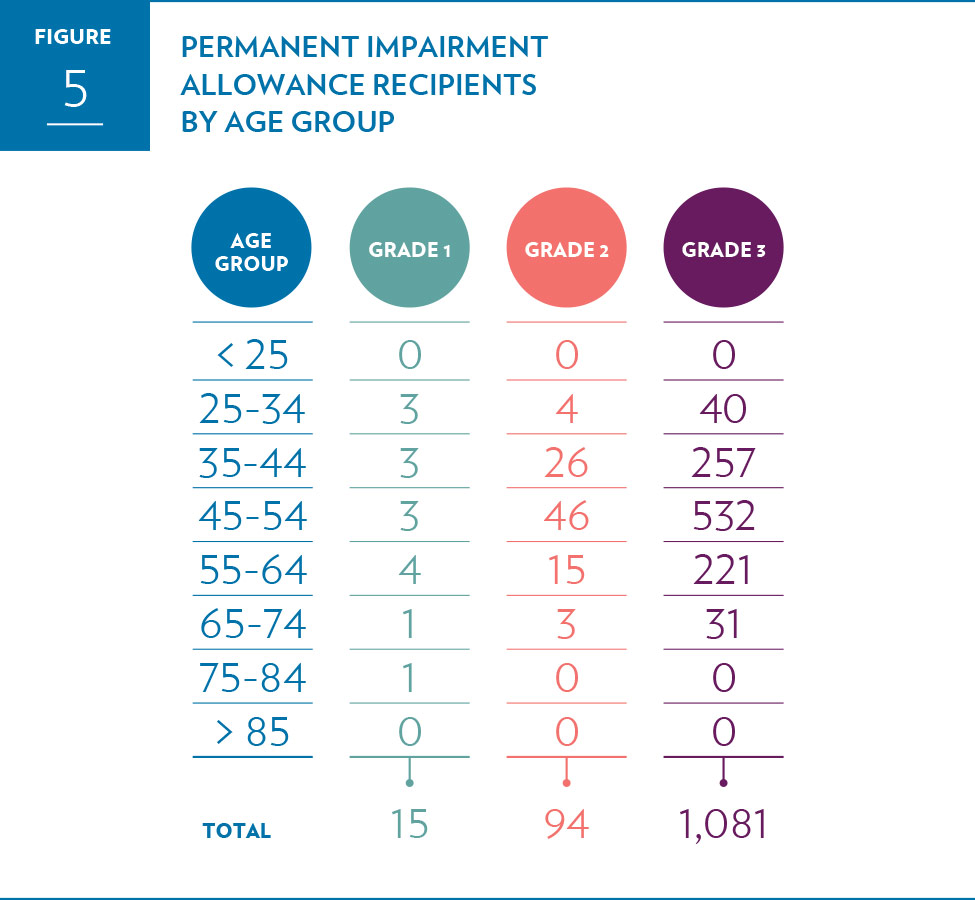

Figure 5 presents statistics for Permanent Impairment Allowance recipients in relation to age group. The statistics show that the majority of Veterans who suffer from a permanent and severe impairment, and are awarded the Permanent Impairment Allowance, are between the ages of 36 and 64. Half of the Veterans are in the 45-54 age group. Thus, the recipients of the allowance tend to be older Veterans, and their loss of earning capacity (until retirement) will be affected for a shorter period of time than the earning capacity of younger Veterans in receipt of the allowance. The relevance of the age factor will become clear in the discussion that follows on proposed changes to the way grade levels are assigned.

Figure 5: Permanent Impairment Allowance recipients by age group

Permanent Impairment Allowance recipients by age group

| Age Group | Grade 1 | Grade 2 | Grade 3 |

|---|---|---|---|

| < 25 | 0 | 0 | 0 |

| 25-34 | 3 | 4 | 40 |

| 35-44 | 3 | 26 | 257 |

| 45-54 | 3 | 46 | 532 |

| 55-64 | 4 | 15 | 221 |

| 65-74 | 1 | 3 | 31 |

| 75-84 | 1 | 0 | 0 |

| > 85 | 0 | 0 | 0 |

| Total | 15 | 94 | 1,081 |

Permanent Impairment Allowance Supplement Policy

Eligibility

As discussed in the ‘Overview of Benefits’ section, to be eligible for the Supplement, a Veteran must be in receipt of the Permanent Impairment Allowance at any grade level and be assessed as totally and permanently incapacitated. In short, to receive the Supplement, a Veteran must be both permanently and severely impaired and totally and permanently incapacitated.

However, a Veteran may be assessed to be totally and permanently incapacitated, but may not be eligible for the Supplement because his or her medical condition does not meet the definition of permanent and severe impairment, as stipulated in the Canadian Forces Members and Veterans Re-establishment and Compensation Regulations.

This is a paradoxical situation. A totally and permanently incapacitated Veteran may not be eligible for the Supplement because he or she does not meet a prerequisite eligibility condition for the Permanent Impairment Allowance (i.e. a permanent and severe impairment). However, the Veteran may still suffer from a medical condition that satisfies the policy objective for the Supplement: the inability to engage in suitable gainful employment because of total and permanent incapacity.

As indicated earlier, there are 1,911 totally and permanently incapacitated Veterans who suffer from a health condition that prevents them from returning to any occupation that is considered to be suitable and gainful employment. However, despite their incapacity, almost half of these Veterans are not receiving the Permanent Impairment Allowance, and are therefore not eligible for the Supplement.

Regrettably, VAC could not provide decision letters that explain why totally and permanently incapacitated Veterans were denied eligibility for the Permanent Impairment Allowance and the Supplement. However, the Department advised that 101 totally and permanently incapacitated Veterans are in receipt of the Exceptional Incapacity Allowance, and therefore are not eligible for the Permanent Impairment Allowance or the Supplement. It is also probable that a number of Veterans were assessed to be totally and permanently incapacitated for health conditions unrelated to service and were not awarded a disability benefit; therefore, they too would not be eligible for the Permanent Impairment Allowance and, as a result, the Supplement.

However, what is less clear is how many Veterans are deemed to be totally and permanently incapacitated for service-related health conditions, but have been denied the Permanent Impairment Allowance (and thus the Supplement) because their health condition does not meet the definition of permanent and severe impairment. Also, the Department is unable to confirm how many totally and permanent incapacitated Veterans have simply not applied for the benefits. Finally, given this lack of information, the OVO cannot ascertain what impact the policy disconnect discussed earlier - between the objective of the Permanent Impairment Allowance and the criteria for assessing extent of impairment - has on denying totally and permanent incapacitated Veterans access to the Permanent Impairment Allowance and the Supplement.

Amount of Supplement

VAC explained that the Supplement (monthly rate as of January 1, 2014 $1,056.96) was implemented as an addition to the Permanent Impairment Allowance to help close the gap between the monthly financial support a severely injured or ill Veteran would receive under the New Veterans Charter compared to the support he or she could receive under the Pension Act.

Termination of the Supplement upon Death of the Veteran

The Supplement ceases to be paid upon the death of the Veteran. The earlier analysis regarding the termination of the Permanent Impairment Allowance upon the death of the Veteran also applies to the Supplement.

Permanent Impairment Allowance Supplement Statistics

Eligibility for the Permanent Impairment Allowance Supplement

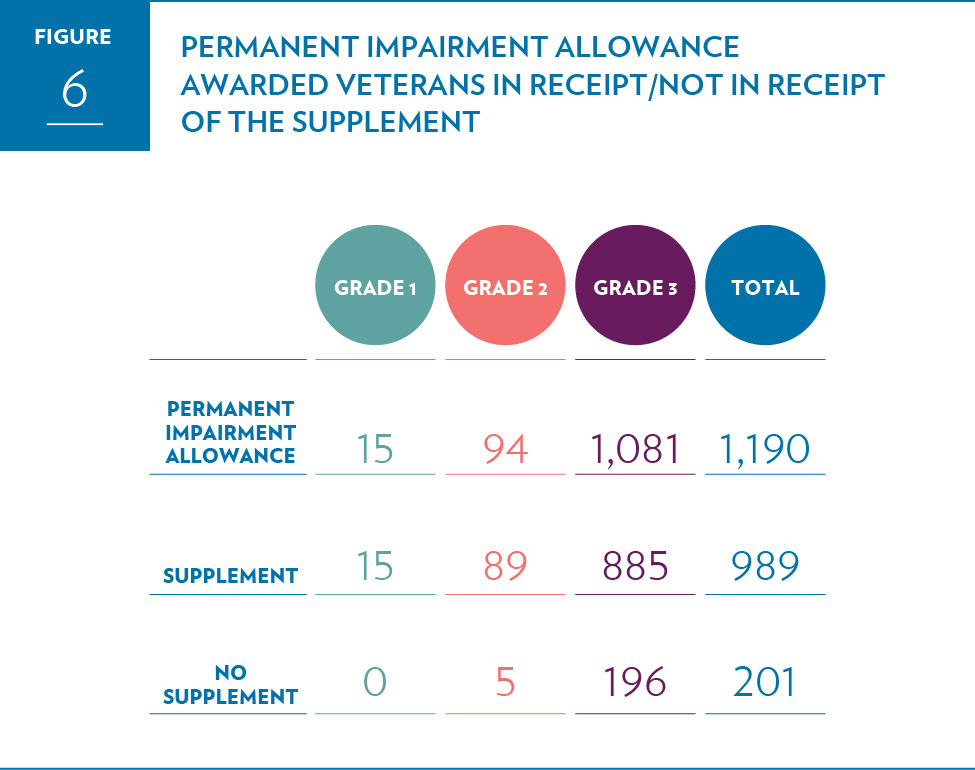

Figure 6 compares the number of Veterans in receipt of the Permanent Impairment Allowance by grade level in relation to the number of these Veterans who either receive or do not receive the Supplement. Of the 1,190 Veterans in receipt of the Permanent Impairment Allowance, 989 (83 percent) are also in receipt of the Supplement. Another way to look at this statistic is that only 17 percent of Veterans who suffer from a permanent and severe impairment and who qualify for the Permanent Impairment Allowance are able to engage in suitable gainful employment.

Figure 6: Permanent Impairment Allowance awarded Veterans in receipt/not in receipt of the Supplement

Permanent Impairment Allowance awarded Veterans in receipt/not in receipt of the Supplement

| Grade 1 | Grade 2 | Grade 3 | Total | |

|---|---|---|---|---|

| Permanent Impairment Allowance | 15 | 94 | 1,081 | 1,190 |

| Supplement | 15 | 89 | 885 | 989 |

| No Supplement | 0 | 5 | 196 | 201 |

As illustrated earlier at Figure 2, 48 percent (924) of the totally and permanently incapacitated Veterans are not receiving the Permanent Impairment Allowance, and thus are not receiving the Supplement. Finally, VAC statistics show that 26 Veterans have been declared totally and permanently incapacitated, have been awarded the Permanent Impairment Allowance, but are not receiving the Supplement. The OVO was unable to determine the reason for this situation.

Importance of the Permanent Impairment Allowance and Supplement for the Financial Security of the Most Severely Impaired Veterans

The Veterans Ombudsman’s recent publications Improving the New Veterans Charter: The Report and Improving the New Veterans Charter: The Actuarial AnalysisFootnote 51describe the positive effects that the Permanent Impairment Allowance and the Supplement have on the financial security of the most severely injured or ill Veterans. These two benefits are particularly important for these vulnerable Veterans because they are paid for life,Footnote 52 and they mitigate, in part, the termination of the Extended Earnings Loss Benefit at age 65.

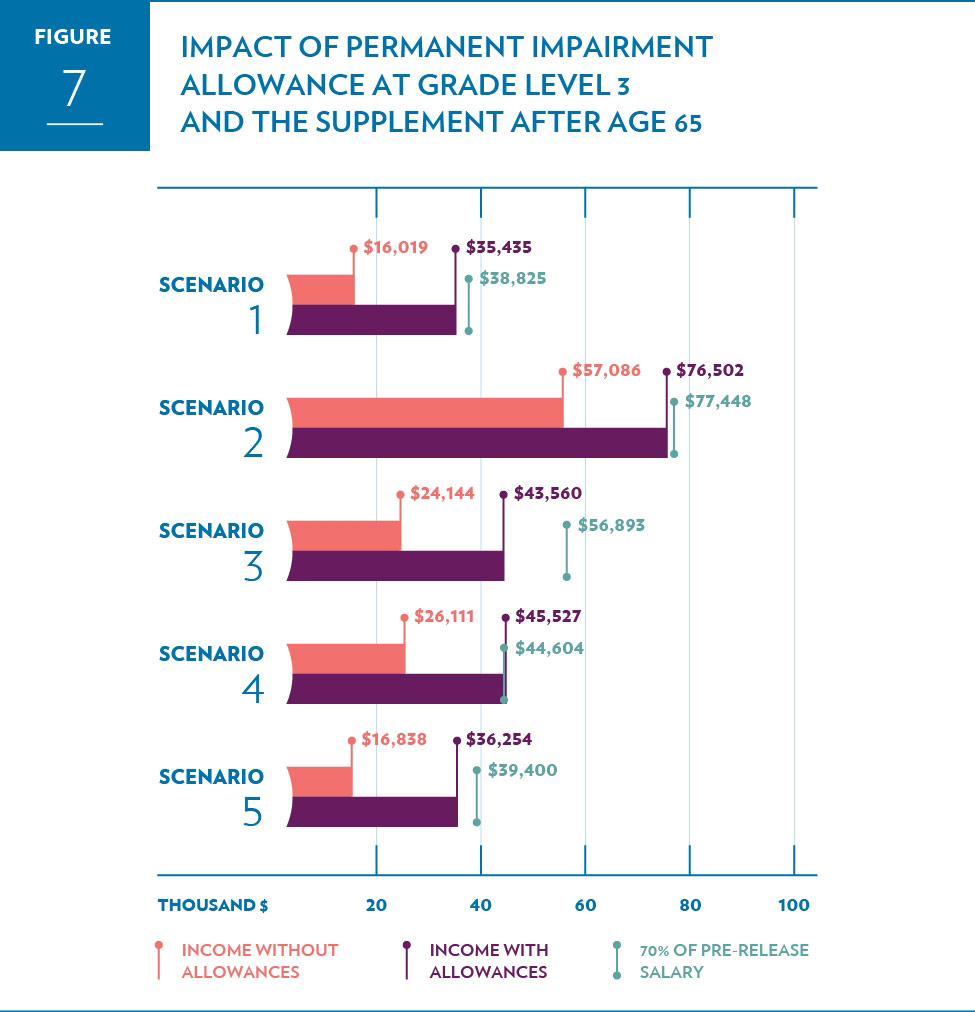

Figure 7, which was extracted from Improving the New Veterans Charter: The ReportFootnote 53, illustrates the effects of the Permanent Impairment Allowance at grade level 3 and the Supplement on after age 65 income for five representative Veteran scenarios. A summary of the scenarios is provided in the annex to this report. As explained in Improving the New Veterans Charter: The Report, 70 percent of pre-release salary is consistent with a commonly accepted benchmark for the amount of retirement income required to maintain a pre-retirement standard of living.

Figure 7: Effects of the Permanent Impairment Allowance at grade level 3 and the Supplement on after age 65.

Effects of the Permanent Impairment Allowance at grade level 3 and the Supplement on after age 65.

| Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | Scenario 5 | |

|---|---|---|---|---|---|

| Income without Allowances | $16,019 | $57,086 | $24,144 | $26,111 | $16,838 |

| Income with Allowances | $35,435 | $76,502 | $43,560 | $45,527 | $36,254 |

| 70% of Pre-release Salary | $38,825 | $77,448 | $56,893 | $44,604 | $39,400 |

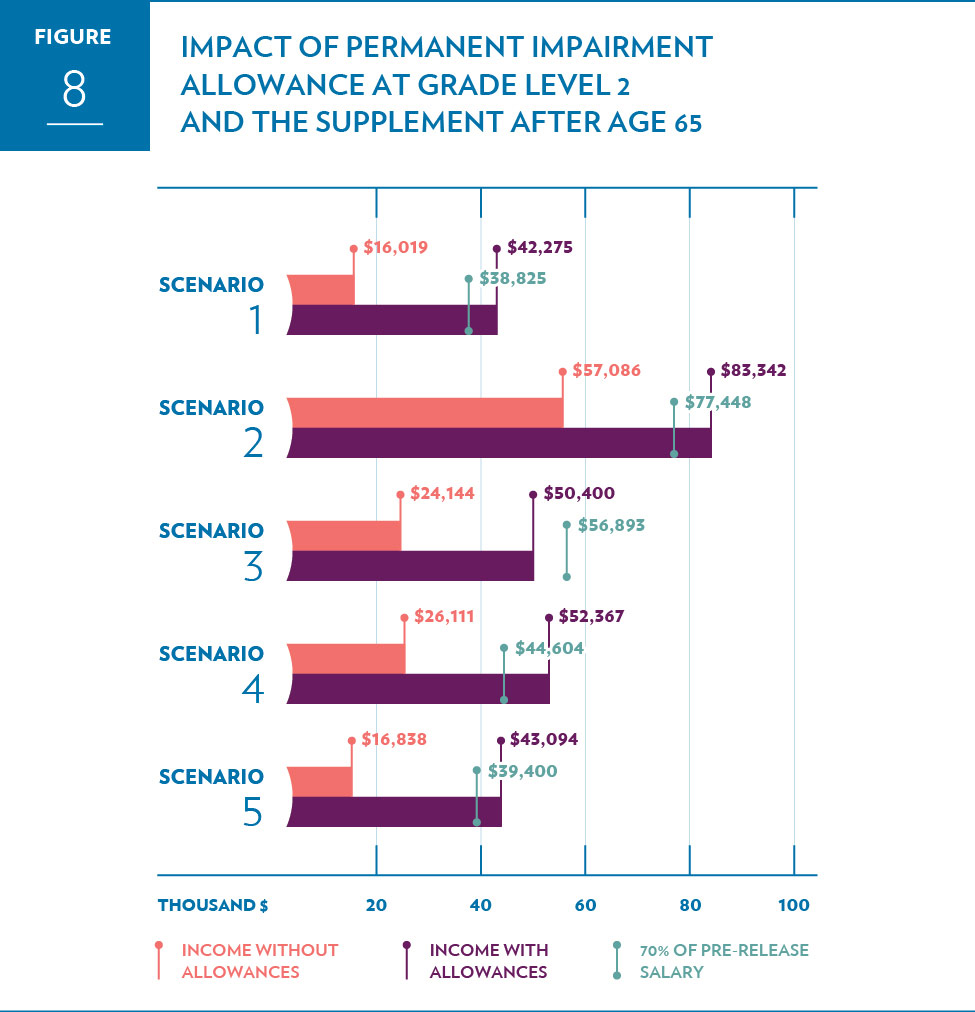

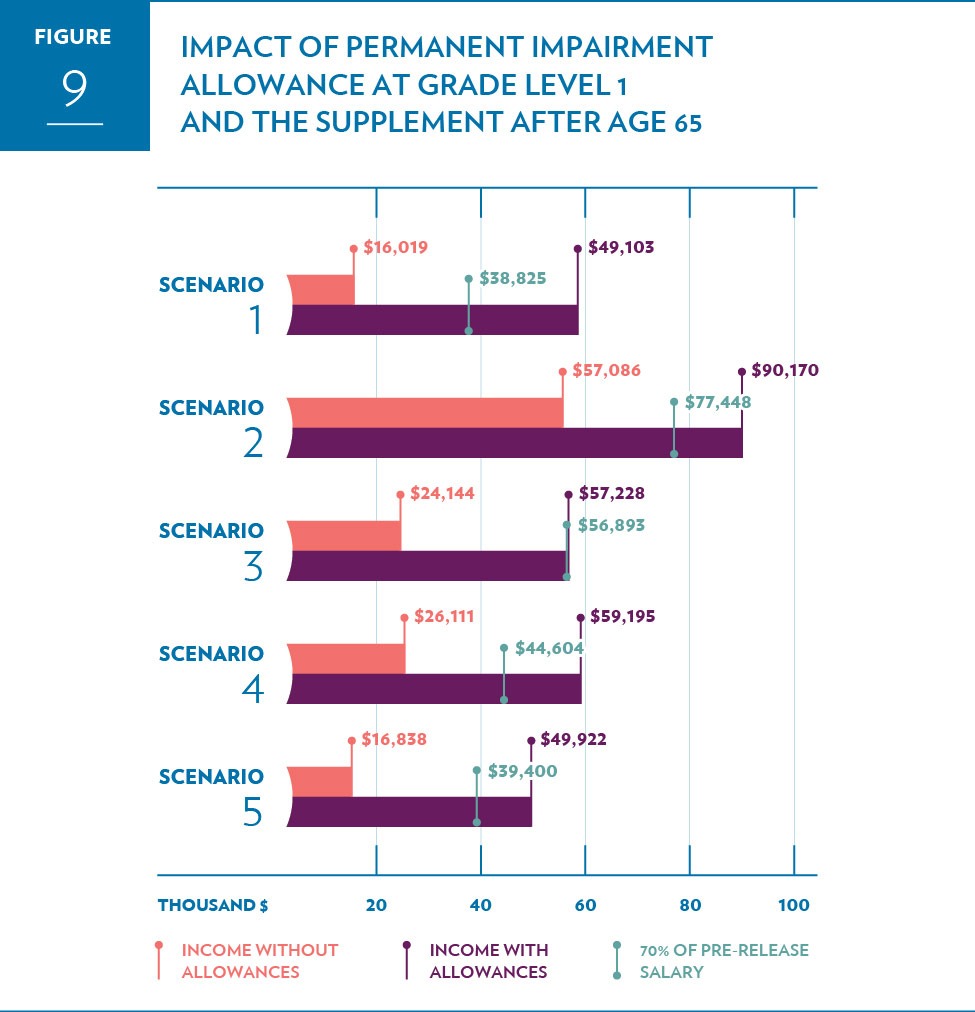

Figures 8 and 9, clearly illustrate the positive impact on the after age 65 income support of the most severely injured or ill Veterans when the Permanent Impairment Allowance is paid at grade levels 2 and 1.

Figure 8: Impact of Permanent Impairment Allowance at grade level 2 and the Supplement after age 65.

Impact of Permanent Impairment Allowance at grade level 2 and the Supplement after age 65.

| Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | Scenario 5 | |

|---|---|---|---|---|---|

| Income without Allowances | $16,019 | $57,086 | $24,144 | $26,111 | $16,838 |

| Income with Allowances | $42,275 | $83,342 | $50,400 | $52,367 | $43,094 |

| 70% of Pre-release Salary | $38,825 | $77,448 | $56,893 | $44,604 | $39,400 |

Figure 9: Impact of Permanent Impairment Allowance at grade level 1 and the Supplement after age 65.

Impact of Permanent Impairment Allowance at grade level 1 and the Supplement after age 65.

| Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | Scenario 5 | |

|---|---|---|---|---|---|

| Income without Allowances | $16,019 | $57,086 | $24,144 | $26,111 | $16,838 |

| Income with Allowances | $49,103 | $90,170 | $57,228 | $59,195 | $49,922 |

| 70% of Pre-release Salary | $38,825 | $77,448 | $56,893 | $44,604 | $39,400 |

Summary of Findings

Definition of “permanent and severe impairment” is restrictive

The list that defines a permanent and severe impairment at Canadian Forces Members and Veterans Re-establishment and Compensation Regulations section 40 is restrictive. It does not provide the flexibility to allow VAC disability adjudicators to consider other permanent and severe injuries or illnesses that could result in loss of employment and career progression opportunities. This limitation impacts the eligibility for the Permanent Impairment Allowance and the Supplement.

Disconnect between Permanent Impairment Allowance policy objective and criteria for assessing extent of impairment and awarding grade levels

There is a disconnect between the policy objective of the Permanent Impairment Allowance and the predominance of functional, physical and mental impairment criteria used to assess the extent of impairment, and thus the eligibility for the benefit. Loss of earning capacity criteria are not included in the list of criteria to consider when assessing the extent of impairment. This affects eligibility for the Permanent Impairment Allowance, and potentially the Supplement, because the adjudication of an application is weighed towards the degree of functional, physical and mental impairment rather than the stated objective of the allowance – the effect of a permanent and severe impairment on loss of employment and career progression opportunities.

In addition, the overwhelming majority of Veterans who receive the Permanent Impairment Allowance, including those who are totally and permanently incapacitated and cannot engage in suitable gainful employment, are awarded the lowest grade level. The OVO could find no evidence that disability adjudicators consider the effect of a permanent and severe impairment on a Veteran’s loss of employment and career progression opportunities when assigning a grade level.

Many totally and permanently incapacitated Veterans are not receiving the Permanent Impairment Allowance and the Supplement.

Forty-eight (48) percent of totally and permanently incapacitated Veterans are not receiving the Permanent Impairment Allowance, and thus the Supplement. These Veterans suffer from a health condition that prevents them from returning to any occupation that is considered to be suitable and gainful employment. Yet, despite their level of incapacity, they are not considered to suffer from a permanent and severe impairment; therefore, they do not meet the eligibility criteria for the Permanent Impairment Allowance, and they are also not eligible for the Supplement. While 101 of these Veterans are in receipt of the Exceptional Incapacity Allowance and are therefore not eligible for the Permanent Impairment Allowance and the Supplement, VAC could not confirm why all the other totally and permanently incapacitated Veterans are not receiving these benefits.

Improving Access to the Benefits

The policy objectives for the Permanent Impairment Allowance and the Supplement should remain as currently stated. Providing additional financial support to compensate the most severely injured or ill Veterans for loss of employment and career progression opportunities, or the inability to engage in suitable gainful employment, are appropriate objectives. However, to improve access to the Permanent Impairment Allowance and the Supplement, legislative, regulatory and policy amendments are required to properly align eligibility criteria and compensation levels with policy objectives.

Expanding the Definition of Permanent and Severe Impairment

Section 40 of the Canadian Forces Members and Veterans Re-establishment and Compensation Regulations should be expanded to include, “other permanent and severe injury or illness that affects employment and career progression opportunities” in the definition of a permanent and severe impairment.

Currently, a Veteran’s impairment cannot be assessed to be permanent and severe based strictly on the effect of the impairment on loss of employment and career progression opportunities. Other conditions must apply such as the requirement for assistance with activities of daily living. Yet, the objective of the Permanent Impairment Allowance is to compensate for the effect of a permanent and severe impairment on loss of employment and career progression opportunities. It makes sense, therefore, to add the generic category “other permanent and severe injury or illness that affects employment and career progression opportunities” to the list at Section 40 to properly align the objective of the benefit with this defining criteria.

This addition will, when combined with the other proposed changes described below, improve access to the Permanent Impairment Allowance and the Supplement for Veterans who suffer from any service-related permanent and severe injury or illness that affects their employment and career progression opportunities.Footnote 54

Recommendation 1: That the Minister of Veterans Affairs amends section 40 of the Canadian Forces Members and Veterans Re-establishment and Compensation Regulations to include, “other permanent and severe injury or illness that affects employment and career progression opportunities” in the definition of a permanent and severe impairment.

Assessing Extent of Impairment

An amendment is also required in VAC policies and relevant regulations to the criteria that are considered by disability adjudicators when determining the extent of impairment and eligibility for the Permanent Impairment Allowance. The policy needs to include specific loss of earning capacity criteria such as the ability to learn new skills, work experience, capacity to meet workplace productivity demands, etc.

A review of the Canada Pension Plan Adjudication Framework may be useful in developing appropriate criteria. When assessing eligibility for the Canada Pension Plan disability pension, the adjudicator’s focus is on assessing the impact of a severe and prolonged disability on the individual’s capacity for work. A number of criteria are considered such as the individual’s ability to perform all tasks and duties associated with a job, his productivity, the profitability of the work activity, and personal characteristics such as age, education and work experience.Footnote 55

VAC conducts, through its vocational rehabilitation and assistance service provider, an employability and neuropsychological assessment, functional capacity evaluation and labour market analysis to determine whether a Veteran can participate in vocational rehabilitation and assistance to engage in suitable, gainful employment. Based on this information, relevant medical documentation and appropriate loss of earning capacity criteria, disability adjudicators will be able to determine whether a Veteran suffers from a permanent and severe medical condition that affects his employment and career progression opportunities.

The focus of the extent of impairment assessment should be to confirm that a Veteran suffers from a permanent and severe impairment that affects his employment and career progression opportunities. The assignment of a specific Permanent Impairment Allowance Grade Level should follow as a separate process, as explained below.

Recommendation 2: That the Minister and the Department of Veterans Affairs amend the relevant Permanent Impairment Allowance policy and regulations to include specific loss of earning capacity criteria to ensure alignment between the determination of the extent of impairment and the objective of the allowance.

Assigning the Grade Level

Currently, disability adjudicators focus on functional, physical and mental criteria to assess the extent of impairment, and to assign a grade level that corresponds to the assessed extent of impairment. The following example reiterates the current approach.

A disability adjudicator assesses that a Veteran suffers from a service-related psychiatric condition with persistent depressive and anxiety symptoms causing continual distress. The condition requires chronic use of medication and psychiatric care.Footnote 56 The Veteran is also designated totally and permanently incapacitated because he is unable to engage in suitable, gainful employment because of his medical condition.

Based on current ‘extent of impairment’ criteria, the disability adjudicator determines that the Veteran is eligible for the Permanent Impairment Allowance at the lowest grade level. Because he is totally and permanently incapacitated, he is also awarded the Supplement. The fact that the Veteran’s medical condition has a profound impact on his employment and career progression opportunities has no bearing whatsoever on the awarding of a grade level; rather, it is the nature of the impairment that determines the grade level. This is inconsistent with the objective of the Permanent Impairment Allowance.

What should occur is that once a disability adjudicator has determined that a Veteran suffers from a permanent and severe impairment and is eligible for the Permanent Impairment Allowance,Footnote 57 the adjudicator will then assess the degree of impact of that impairment on loss of employment and career progression opportunities. This should correlate to a grade level; i.e., the greater the impact of the impairment on loss of employment and career progression opportunities, the higher the grade level.

The assessment should also consider the number of working years that will be affected by the impairment. By adopting this approach, a young Veteran whose permanent and severe impairment affects his earning capacity, and thus the amount of wealth that he can generate throughout his working years, would receive the Permanent Impairment Allowance at a higher grade level than an older Veteran with a similar impairment, but who has fewer working years ahead of him. Figure 5 presented statistics on the age distribution of Permanent Impairment Allowance recipients.

This approach will ensure consistency between the objective of the Permanent Impairment Allowance and the amount of compensation. Permanent Impairment Allowance Grade Levels would now truly be awarded based on the effect of a permanent and severe impairment on loss of employment and career progression opportunities. The allowance would also be awarded based on need because a young Veteran whose impairment affects his earning capacity for many years normally has a greater need for financial support than an older Veteran who suffers from a similar impairment, but whose earning capacity is affected for fewer years.

An age-based compensation approach is not unique; it is used by other nations to compensate disabled Veterans. For example, it is used by the United Kingdom for the Guaranteed Income PaymentFootnote 58 provided to the most seriously disabled Veterans. To calculate the amount of this payment, an age factor is applied; the younger the Veteran, the higher the factor because there are more years of loss of earnings capacity until retirement for the younger person than for the older one. In Australia, when a Veteran selects permanent impairment compensation as a lump sum instead of a periodic payment, the amount of the lump sum is adjusted based on the age of the Veteran.Footnote 59

Recommendation 3: That the Minister and the Department of Veterans Affairs amend the Permanent Impairment Allowance policy and the relevant regulations so that the assignment of grade levels is based on specific criteria (including the number of working years affected) that characterize the impact of a permanent and severe impairment on loss of employment and career progression opportunities.

Payment of Permanent Impairment Allowance and Supplement to the Survivor Footnote 60

The Permanent Impairment Allowance and the Supplement should be provided to the survivor at the full rate for a period of one year following the death of the Veteran, if the Veteran was in receipt of the benefits at the time of death. This will ensure consistency with other VAC benefits that are continued after the death of the Veteran. More significantly, however, it will provide a period of financial stability following the death of the Veteran to allow the survivor to adjust to his or her new financial circumstances.

Recommendation 4: That the Minister of Veterans Affairs amends legislation to provide the Permanent Impairment Allowance and the Supplement to a survivor at the full rate for a period of one year following the death of the Veteran, if the Veteran was in receipt of the benefits at the time of death.

Conclusion

This report identifies issues with respect to accessibility to two New Veterans Charter financial benefits - the Permanent Impairment Allowance and the Supplement - which were implemented to provide additional financial support to the most severely injured or ill Veterans. Accessibility is one of the Veterans Ombudsman’s three measures of fairnessFootnote 61 with regards to the benefits and services provided to Veterans and their families.

Severely impaired Veterans can face a lifetime of loss of employment and career progression opportunities. While the policy objectives for the Permanent Impairment Allowance and the Supplement appropriately recognize that the most severely impaired Veterans deserve and need additional financial support to compensate for the impact of their impairment on loss of employment and career progression opportunities, the evidence presented in this report clearly demonstrates that too many severely impaired Veterans are either not receiving these benefits or may be receiving them at a grade level that is too low. This is unfair and needs to be corrected.

The underlying problem is that the adjudication of an application for the Permanent Impairment Allowance is weighed towards the consideration of functional, physical and mental criteria when assessing extent of impairment. This is inconsistent with the objective of the benefit, and it affects the determination of eligibility for the allowance, the assignment of grade levels, and the eligibility for the Supplement.

This report makes four recommendations to improve access to the Permanent Impairment Allowance and the Supplement. First, the list at section 40 of the Canadian Forces Members and Veterans Re-establishment and Compensation Regulations that is used to define a permanent and severe impairment needs to be expanded to include: “other permanent and severe injury or illness that affects employment and career progression opportunities”. This will provide alignment between the definition of permanent and severe impairment and the objective of the Permanent Impairment Allowance.

The second recommendation is for the Minister and the Department to amend the list of criteria found in VAC policies and regulations that are considered by disability adjudicators when determining extent of impairment and eligibility for the Permanent Impairment Allowance. The list needs to include specific loss of earning capacity criteria.

Third, a new approach is required to assigning Permanent Impairment Allowance Grade Levels. The degree of impact of a permanent and severe impairment on loss of earning capacity should be the main determinant in assigning a grade level; the greater the impact of the impairment on loss of earning capacity, the higher the grade level.

A final recommendation is made to better support the survivor of a Veteran who was eligible for the Permanent Impairment Allowance and for the Supplement by continuing the benefits for a period of one year following the death of the Veteran.

By implementing the recommendations in this report, VAC will improve accessibility to the Permanent Impairment Allowance and the Supplement. This will help ensure that the most seriously injured and ill Veterans are provided the additional economic financial support they need to compensate for loss of employment and career progression opportunities. It will also provide financial stability and security to the Veteran’s survivor.

Recommendations

The Veterans Ombudsman makes the following recommendations:

Recommendation 1: That the Minister of Veterans Affairs amends section 40 of the Canadian Forces Members and Veterans Re-establishment and Compensation Regulations to include, “other permanent and severe injury or illness that affect employment and career progression opportunities” in the definition of a permanent and severe impairment.

Recommendation 2: That the Minister and the Department of Veterans Affairs amend relevant Permanent Impairment Allowance regulations and policy to include specific loss of earning capacity criteria to ensure alignment between the determination of the extent of impairment and the objective of the allowance.

Recommendation 3: That the Minister and the Department of Veterans Affairs amend the Permanent Impairment Allowance policy and the relevant regulations so that the assignment of grade levels is based on specific criteria (including the number of working years affected) that characterize the impact of a permanent and severe impairment on loss of employment and career progression opportunities.

Recommendation 4: That the Minister of Veterans Affairs amends legislation to provide the Permanent Impairment Allowance and the Supplement to a survivor at the full rate for a period of one year following the death of the Veteran, if the Veteran was in receipt of the benefits at the time of death.

Annex

Summary of Scenarios

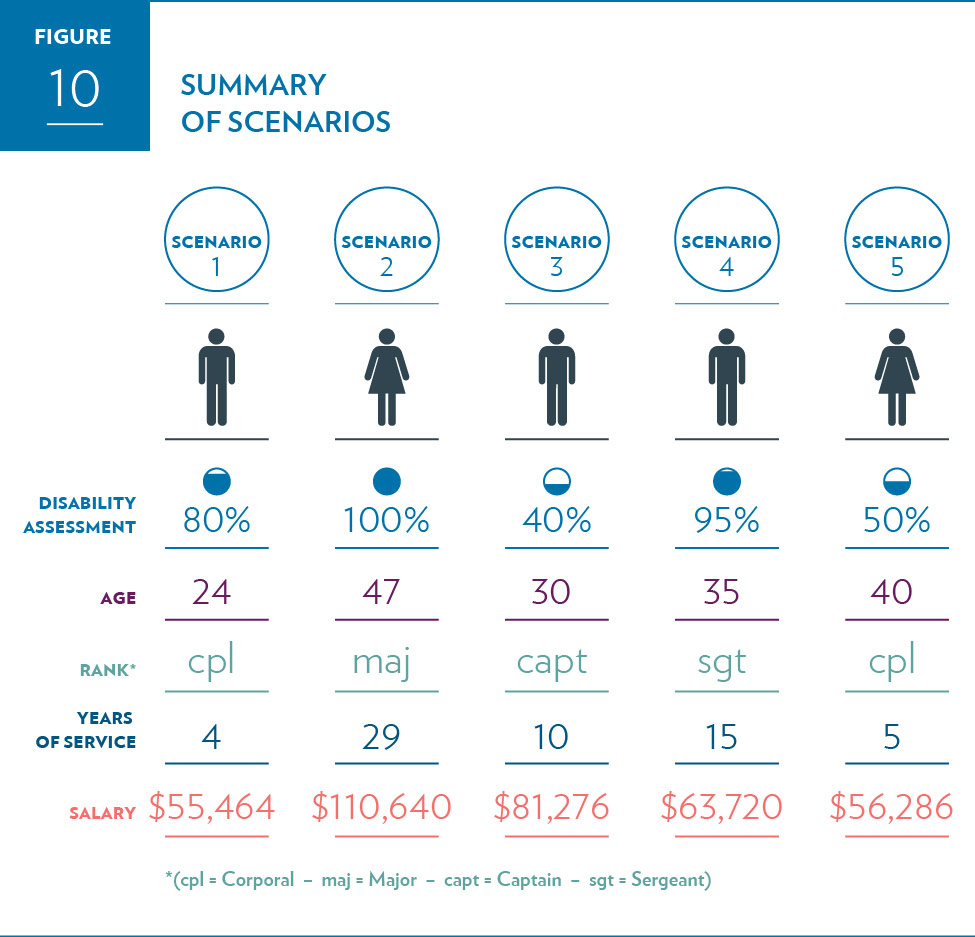

A recapitulation of the five scenarios modelled in the Veterans’ Ombudsman report Improving the New Veterans Charter: The Report is provided at Figure 10.

Figure 10: Summary of scenarios

Summary of scenarios

| Scenario | Gender | Disability Assessment | Age | Rank | Years of Service | Salary |

|---|---|---|---|---|---|---|

| 1 | Male | 80% | 24 | Corporal | 4 | $55,464 |

| 2 | Female | 100% | 47 | Major | 29 | $110,640 |

| 3 | Male | 40% | 30 | Captain | 10 | $81,276 |

| 4 | Male | 95% | 35 | Sergeant | 15 | $63,720 |

| 5 | Female | 50% | 40 | Corporal | 5 | $56,286 |