Issue

The Office of the Veterans Ombudsman (OVO) received a complaint from a Veteran about not being advised, when potentially eligible, about the Supplementary Retirement Benefit (SRB) and the eligibility requirements; i.e., tied to eligibility for the Earnings Loss Benefit. This advice shortcoming may be because any amount payable through ELB would be offset by CAF-LTD (both payable at the same rate), and therefore there was no perceived advantage of applying for it. In fact, though, there would have been an advantage, since the amount of ELB payable (whether paid or not) is used to calculate the SRB. Therefore, had the Veteran been advised to do so, they would have applied for the VAC Rehabilitation Program and the Earning Loss Benefit (ELB) at that time, thus increasing the total amount of ELB factored into the SRB calculation. When the SRB was discontinued in 2019, with the introduction of Pension for Life, automatic lump sum payouts, based on the amount of ELB payable (whether paid or not), began in September-October of that year. Due to a lack of information and advice, this Veteran’s SRB payoutFootnote 1 will be less than it would have been had they applied earlier - (see Annex A for scenarios).

A review of the Veteran’s complaint points to a possible systemic issue relating to the way Veterans were counselled (or not counselled) regarding SRB eligibility at the time it was introduced. This issue is not about ensuring Veterans are financially secure, but rather a case of equity, where a Veteran should not be disadvantaged in terms of an SRB payout due to a lack of knowledge or understanding about VAC programs. Because its intended outcome was achieved with the introduction of the Retirement Income Security Benefit (RISB), and more recently with the extended Income Replacement Benefit (IRB) under Pension For Life (PFL), the SRB could have been cancelled without a payout. Since this option was not chosen a potential inequity has arisen. Based on this potential inequity, the OVO initiated an investigation to determine if outcomes for Veterans under the legislation are fair.

Factual Background

The OVO research shows that:

- The New Veterans Charter (NVC) requires separate formal applications for each program (Rehabilitation Program, Earnings Loss Benefit [ELB], Supplementary Retirement Benefit [SRB], and others).

- VAC programs are complex; ill and injured Veterans are often overwhelmed by VAC administrative processes.

- Eligibility for SRB is especially complicated in that it hinges on eligibility for two other benefits; namely, Rehabilitation Services and Vocational Assistance Program (hereafter referred to as the VAC Rehabilitation Program) and the ELB.

- Veterans are eligible for ELB as long as they are in the VAC Rehabilitation Program. If they are deemed Totally and Permanently Incapacitated (TPI)/ Diminished Earnings Capacity (DEC), they are eligible for extended ELB (beyond age 65 with the implementation of PFL). To be eligible for SRB, Veterans must be both approved for ELB and deemed TPI/DEC.

- TPI/DEC is determined by VAC, based on the Veteran’s capacity to return to any occupation which can provide suitable, gainful employment.

- CAF Long-Term Disability (CAF-LTD) is the first payer for vocational rehabilitation and income replacement benefits for medically-released CAF members/Veterans. Therefore, prior to RISB being implemented and the ELB increasing to 90% of pre-release salary, Veterans receiving CAF-LTD benefits may have been under the impression that there was no benefit in applying for VAC Rehabilitation and ELB. As a result, eligible Veterans who did not apply for these two VAC programs would therefore have missed out on SRB.

- SRB is based on 2% of VAC ELB payable (before offsets considered).

- Since fiscal year 2006-07 there have been 11,003 Veterans deemed TPI/DEC, and thus eligible for SRB. There have been 392 SRB recipients between 2006-07 and 2019-20. VAC forecasts 10,400 SRB recipients (deemed DEC but not yet 65 years old) in fiscal year 2019-2020 (because of the program end and payoutFootnote 2.

- The SRB program ended on 31 March 2019, just prior to implementation of PFL on 1 April 2019. SRB payouts commenced automatically, with payouts beginning in September-October 2019, calculated up to 31 March 2019, for all those eligible.

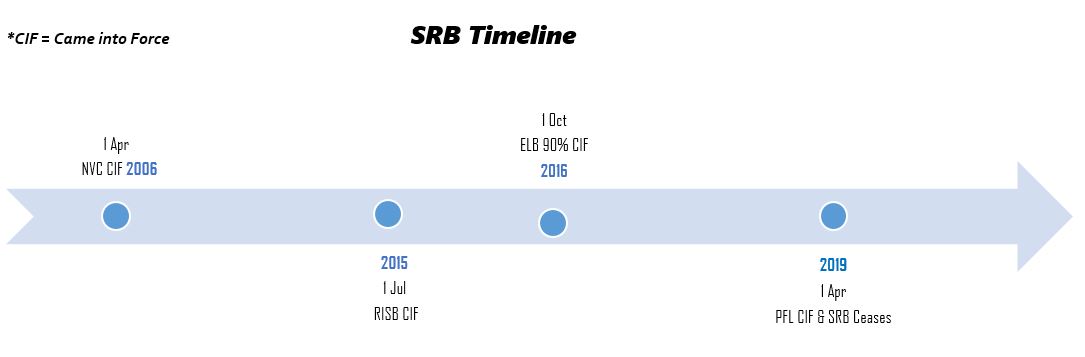

SRB Timeline

Alternative text

*CIF = Came into Force

- 2006

1 Apr NVC CIF - 2015

1 Jul RISB CIF - 2016

1 Oct ELB 90% CIF - 2019

1 Apr PFL CIF & SRB Ceases

Annex B (History and Investigation of the Supplementary Retirement Benefit) provides an overview of the NVC financial benefits, including SRB, as well as a review of reports commenting on the effectiveness of the NVC implementation and its complexity.

Discussion/Analysis

As shown in Annex B, VAC implemented the New Veterans Charter (NVC) on 1 April 2006, which offered numerous new programs, with complex eligibility criteria, and all requiring individual applications. This complexity was compounded by the VAC/CAF/SISIP Program ArrangementFootnote 3 in two ways: it named CAF-LTD as the first payer for vocational rehabilitation and income replacement benefits (for eligible medically-released CAF members/Veterans) and stipulated that VAC ELB would be entirely offset by any CAF-LTD payment (both payable at 75% of pre-release income). Therefore, prior to the implementation of RISB and ELB 90%, unless the Veteran had other VAC needs (which were often covered under treatment benefits), there was little incentive to complete the administrative process to apply for a rehabilitation program that provided no perceived benefit.

The criteria for SRB is more complex and nuanced than other benefits. It may be applied for well after release from the CAF (potentially 40 years or more later) and it is contingent on the eligibility for and receipt of the VAC Rehabilitation Program, ELB and a TPI/DEC designation. Prior to the implementation of RISB and ELB 90%, the ELB payable and CAF LTD payable were comparable so there was no apparent benefit to the Veteran to apply for the former. As highlighted in the 2012 Office of the Auditor General (OAG) report (see Annex B), VAC front-line workers were not fully conversant with the details of the NVC programs; it is unreasonable, therefore, to expect Veterans (especially the ill and injured) to understand the nuanced criteria.

OVO Assessment

The OVO investigates systemic issues using a fairness model with three components: Fair Treatment, Fair Process, and Fair Outcome. Fair Treatment is about how VAC relates to Veterans. Fair Process is about how the decisions are made by VAC. Fair Outcome is about whether the ultimate decision is fair. See Annex C for full definitions.

Fairness

From a regulatory and legislative perspective, the amount of Supplementary Retirement Benefit is calculated based on the amount of Earnings Loss Benefit the Veteran would have received if not for offsets. When the fairness lens is applied to this issue, it becomes clear that some Veterans would receive better outcomes than others, based solely of knowledge of the program, rather than on need or circumstances.

- Fair Treatment. Although VAC did not deliberately prevent access to the SRB, it did not provide clear, easy-to-understand information which would enable Veterans to make an informed decision on program application. A program with such complex and confusing eligibility criteria is difficult for both Veterans and VAC staff to understand. This lack of understanding leading to a failure to apply does not result in fair treatment.

- Fair Process. Using the start date for ELB to determine the SRB calculation is unfair. Doing so ignores the lack of clear information on eligibility for, and need to apply for, benefits. Veterans deemed Totally Disabled (TD) by CAF-LTD are, by definition, the most seriously ill and injured. If VAC proactively contacted Veterans who were deemed TD and advised them about the eligibility criteria for SRB, most would have applied for the VAC Rehabilitation Program and ELB even if there was no immediate financial gain (i.e., VAC ELB would have been offset by CAF-LTD). This proactive approach was subsequently used when the Retirement Income Security Benefit (RISB) was introduced and the ELB increased to 90% of pre-release income.

- Fair Outcome. The amount of SRB payment should not be based on whether the Veteran received the correct advice or whether they could understand the complex eligibility criteria enough to apply for a Rehabilitation benefit for which they had no immediate need. Basing the payment on when Veterans would have first been eligible for ELB, using available CAF-LTD information, would result in a fair outcome for all.

Recommendations

From a fairness perspective, the following recommendations would ensure that all eligible Veterans would receive a similar outcome:

- Review the SRB eligibility start date of all dual CAF-LTD and VAC Veterans released prior to 1 October 2016 and deemed TPI/DEC. Veterans released after this date are assumed to be in receipt of ELB because of the VAC outreach connected to the implementation of the 90% top up of CAF-LTD benefits;

- If a Veteran’s SRB eligibility start date is later than the payment commencement date for CAF-LTD, use the latter date as the eligibility start date for calculation of the SRB payout (going back as early as 1 April 2006); and

- From a fairness perspective, and to achieve equitable outcomes, it is recommended that the Minister of Veterans Affairs and VAC recalculate the SRB payable based on the adjusted eligibility date and pay the corrected amount to eligible Veterans.

Annexes

Annex A – Scenarios

Annex B – History and Investigation of the Supplementary Retirement Benefit

Annex C – OVO Fairness Definitions

Annex A

Scenarios

In 2004, following eight years of service, a 30-year-old CAF member is released as a result of a serious service related injury. During the release process the Veteran applies and is approved for CAF-LTD. Because of the nature of the injuries, the Veteran is immediately assessed as Totally Disabled and told they will receive (from CAF-LTD) 75% of their pre-release salary (less offsets) until they turn 65. The Veteran contacts VAC for benefits, and is advised to apply for a Disability Pension, which is later approved, along with treatment benefits.

In April 2006, the Veteran hears about the NVC and contacts VAC to see if there are benefits they could receive.

Scenario A

The Veteran is told that there is no point in applying for the VAC Rehabilitation program or ELB because: Vocational Rehabilitation is not practical given the extent of their injury, their income replacement is coming from CAF-LTD, and all their medical needs are covered by their treatment benefits as a result of the pensioned condition.

In September 2016, the Veteran receives a letter advising them of the pending increase in VAC ELB to 90% and to contact VAC regarding eligibility. Because the Veteran’s injuries are service related, they are approved for ELB (at 90%, less offsets [including their 75% CAF-LTD payments]) and are entered into pay as of 1 November 2016. At this time the Veteran is also assessed for and determined to be TPI, which makes them eligible for RISB when they turn 65 years old.

With the implementation of PFL and the cancellation of the SRB, the Veteran is eligible for an SRB payout based on 29 months ELB x 2% (November 2016 to 31 Mar 2019).

Scenario B

The Veteran is told that because they have a service related rehabilitation need, they are eligible for the Rehabilitation program. The Veteran applies for Rehabilitation and ELB, which are both approved (effective 1 June 2006) while they await a rehabilitation assessment. Since they are already receiving income replacement from CAF-LTD, their ELB payment is reduced to $0.00. The Veteran’s rehabilitation assessment determines they will never be able to be suitably and gainfully employed and they are deemed TPI. The Veteran remains on the Rehabilitation Program for a few months to work on some re-establishment needs before their rehabilitation plan is closed. They remain on extended ELB, although there is no payment.

In September 2016, the Veteran receives a letter advising them of the pending increase in VAC ELB to 90% and to contact VAC regarding eligibility. Because the Veteran is already on extended ELB, VAC automatically adjusts their ELB amount to 90%, and they start receiving an ELB payment from VAC (15% payment) as of 1 November 2016.

With the implementation of PFL and the cancellation of the SRB, the Veteran is eligible for an SRB payout based on 154 months ELB x 2% (June 2006 to 31 Mar 2019.

In Scenario B, where adequate counselling and advice from VAC was received, the Veteran has a better financial outcome than in Scenario A.

Annex B

History and Investigation of the Supplementary Retirement Benefit

History

On 1 April 2006, the Canadian Armed Forces and Veterans Re-establishment and Compensation Act (known as the New Veterans Charter [NVC]) came into force, replacing the Pension Act (PA) for non-war service CAF Veterans. New benefits under the NVC included a Disability Award (DA) (instead of the Disability Pension [DP]), Rehabilitation Services and Vocational Assistance Program (vocational, medical and psychosocial rehabilitation), and new Financial Benefits (Earnings Loss Benefit [ELB], Supplementary Retirement Benefit [SRB], Canadian Forces Income Support [CFIS], and Permanent Impairment Allowance [PIA]). In October 2011 the Permanent Impairment Allowance Supplement (PIAS) was added to the NVC suite of financial benefits. Access to NVC benefits required separate applications for each benefit/program.

The SRB was a financial benefit designed to compensate for the lower pension benefits that might have been payable to a Veteran who had been unable to engage in suitable gainful employment. Eligibility commenced once the Veteran was designated as being Totally and Permanently Incapacitated (TPI) – later renamed to Diminished Earnings Capacity (DEC) – as defined by VAC. To be eligible for the SRB, the Veteran must have been in receipt of an ELB, or would have been in receipt of it but for their level of income. The SRB was a lump-sum taxable benefit [payable at age 65 (or when ELB eligibility ceased) to eligible Veterans and their survivors] equal to 2% of the total amount of ELB payable (before income offsets are considered).

According to the VAC/DND Harmonized Rehabilitation Services Program Arrangement, the CAF-LTD program is the first payer for vocational rehabilitation and income replacement benefits (i.e., CAF-LTD benefit offsets any VAC ELB payment) for medically-releasing CAF members.

On 1 July 2015, VAC implemented the Retirement Income Support Benefit (RISB) to provide life-long financial stability for [eligible] Veterans post-age 65. RISB eligibility required the Veteran to be deemed TPI and have a DA prior to their 65th birthday. The enabling legislation included a provision to deem Totally Disabled (TD) CAF-LTD recipients, who had a VAC DA or DP, as eligible for RISB even if they had not been designated TPI by VAC or applied to VAC for the Rehabilitation Program or financial benefits. VAC also conducted outreach to identify any Veterans, in these circumstances, to evaluate them for RISB. In essence, the legislation accepted the CAF-LTD TD designation as the same as VAC’s TPI designation.

On 1 October 2016, VAC increased the ELB from 75% to 90% of pre-release income. In addition, VAC established a “top-up” to 90% for eligible Veterans who were in receipt of CAF-LTD, which remained at 75%. In preparation for this increase VAC, CAF and Manulife (insurer for CAF-LTD) worked together to identify and contact (by letter) all CAF-LTD recipients to ensure they were aware of the increased benefit, and to apply to the VAC Rehabilitation Program to establish VAC ELB eligibility.

In both the establishment of RISB and the ELB increase, VAC proactively ensured that all potentially eligible clients were aware of the changes so they could apply for the new [and increased] benefits. This proactive outreach acknowledged that some Veterans who may have been eligible for benefits were not in contact with VAC. A proactive approach like this was not taken for the implementation of the NVC back in 2006.

Investigation

SRB eligibility required both ELB eligibility and a TPI designation. Understanding the eligibility is not straightforward as there are a number of pieces that must fall into place. The Veteran must have applied for the VAC Rehabilitation Program to determine eligibility for ELB. To be eligible for the VAC Rehabilitation Program, the Veteran must have had a physical or a mental health problem, resulting primarily from service in the CAF, that was creating a barrier to re-establishment in civilian life. Veterans with that barrier were eligible and could [concurrently] apply for and receive ELB (while awaiting their rehabilitation assessment). If the assessment determined there was no rehabilitation need, the file was closed and ELB ceased. At any time, during the assessment (or while in the Rehabilitation Program), a TPI determination process could be conducted by the case manager in consultation with the Veteran. Veterans deemed TPI would have been eligible for extended ELB (they could also have remained in the Rehabilitation Program).

Prior to RISB and the ELB increase to 90%, many CAF-LTD recipients were under the mistaken impression there was no benefit in applying for the VAC Rehabilitation Program or ELB while in receipt of CAF-LTD income replacement (unless they required psychosocial or medical rehabilitation which was provided by VAC but not by CAF-LTD) because no financial or vocational benefit would have been payable. The complainant at the root of this investigation said they were told [by VAC] that there was no point in applying for the Rehabilitation Program or ELB, as there would have been no VAC benefit payable (CAF-LTD would offset all VAC ELB).

A Veteran who had not applied for the VAC Rehabilitation Program and ELB (because there was no apparent financial or vocational benefit to doing so) and was later declared Totally Disabled (TD) by CAF-LTD, would need to know they had to apply for the VAC Rehabilitation Program, be approved for ELB (even if there was no payment), and be assessed as TPI, in order to be eligible for SRB at age 65. This detailed understanding of VAC benefits was likely known only to program experts schooled in the complexity of the benefit scheme.

Previous studies

Since implementation of the NVC, numerous reports have highlighted the complexity of VAC programs, as well as the difficulty accessing them.

The August 2009 New Veterans Charter (NVC) Evaluation Report, conducted by VAC Audit and Evaluation, highlighted VAC’s failure to fully implement its 2008 outreach plan to help CAF members and Veterans understand the new benefits and services. It noted many [Veterans], especially those individuals with mental health issues, were struggling to complete the numerous forms. It also highlighted the challenges experienced by front-line staff in keeping current with evolving policies; and that new staff felt they did not have a good enough understanding of the programs, services, or benefits to be able to adequately advise Veterans.

The 2012 Fall Report of the Auditor General of Canada dedicated a chapter to The Transition of Ill and Injured Military Personnel to Civilian Life. The chapter highlighted the complexity of the transition process, especially the confusion and misunderstanding resulting from dealing with both CAF and VAC rehabilitation programs. It also highlighted how the complex eligibility criteria made it difficult to complete all the required forms. This situation caused some CAF members and Veterans to miss deadlines for vocational support, or to fail to apply because of incorrect information. While the report mentions steps taken to address identified issues, program officials had not taken sufficient steps during the period covered by the audit to adequately manage the examined services and benefits.

Staff at both DND and VAC told the Office of the Auditor General (OAG) “…that the transition process is complex. They must deal with a large number of departmental policies and procedures, which often change. As a result, employees find it increasingly difficult to understand the process and keep up to date. Some were concerned they might make decisions or provide advice on the basis of outdated information or without having considered all relevant policies.” (Auditor General of Canada, 2012).

The September 2016 VAC Audit and Evaluation Report, entitled Evaluation of the Financial Benefits Program, noted the SRB approval rate in 2014-15 was 50% (of the 42 who applied, 21 were approved). The high denial rate resulted from lack of approval for the [VAC] Rehabilitation Program and therefore ineligibility for ELB, not being designated TPI, or not being 65 years of age or older. The report assessed that the high denial rate indicated applicants were not fully aware of the requirements for SRB, and eligibility criteria were not clearly outlined on the application form. In recognition of the eligibility complexity, the first of the report’s six recommendations called for VAC to implement a monitoring system to assess financial benefits recipients for potential TPI designation before they turn 65.

The 2016 Standing Committee on Veterans Affairs (ACVA) Report on Improving Service Delivery to Canadian Veterans supported both the OAG and VAC reports regarding the complex eligibility criteria for programs and benefits. Numerous witnesses before the Committee discussed the complex regulations and stacks of applications, leading the report to observe “…sometimes esoteric interactions among the eligibility criteria for certain programs can leave the impression that the government is deliberately trying to confuse veterans (sic) by using grounds for refusal that would be far too difficult to challenge.” Although this statement was not specifically directed at SRB, it clearly reflects its complex eligibility criteria.

On 27 June 2019, VAC was asked for information on: 1) the type of outreach that was conducted prior to NVC implementation to determine eligibility [if any] for NVC programs by Pension Act Veterans; 2) whether PA clients were automatically assessed for NVC benefits/programs; 3) whether there was coordination between CAF-LTD (Manulife) and VAC to identify potential dual eligibility under the NVC; and 4) what advice was provided to medically-releasing CAF members regarding the VAC Rehabilitation Program and its potential applicability for CAF-LTD clients. VAC provided some of the information requested on outreach, but it was not sufficiently detailed to alter the recommendations in this investigation. VAC did provide statistics on the number of TPI/DEC Veterans as well as the number of SRB recipients since 2006.

Annex C

OVO Fairness Definitions

Fair Process - How was it decided?

It includes an unbiased decision maker; notice of intent to make a decision; informing the Veteran of the decision-making criteria; an opportunity for the Veteran to provide evidence; timely decisions; and meaningful reasons for the decision.

Fair Treatment – How was the Veteran or family member treated?

It includes being honest and forthright when communicating and providing clear, easy-to-understand information; respecting privacy rights; and treating Veterans with courtesy, dignity and respect.

Fair Outcome – What was decided?

The decision is based on relevant information; and made in accordance with applicable laws, regulations and rules that are fair. The decision should result in equitable outcomes and not be unduly oppressive. Similarly situated individuals should expect similar outcomes.